User Profile Information

| Name: | |

| User ID: | |

| Email: | |

| Email for MFA: | |

| Phone Number for MFA: | |

| MFA Hourly Lock: | |

| MFA Generate New Number Count: | |

| MFA Generate New Number Time: |

Application Access

| Application | Access? |

|---|---|

| Initial Choice Service: | |

| 2nd Choice Service: | |

| Advisor Service: | |

| Online Election: | |

| Manage Investments: | |

| Manage Pension: |

Address

| Address: | |

| City: | |

| State: | |

| Zip: |

User Information

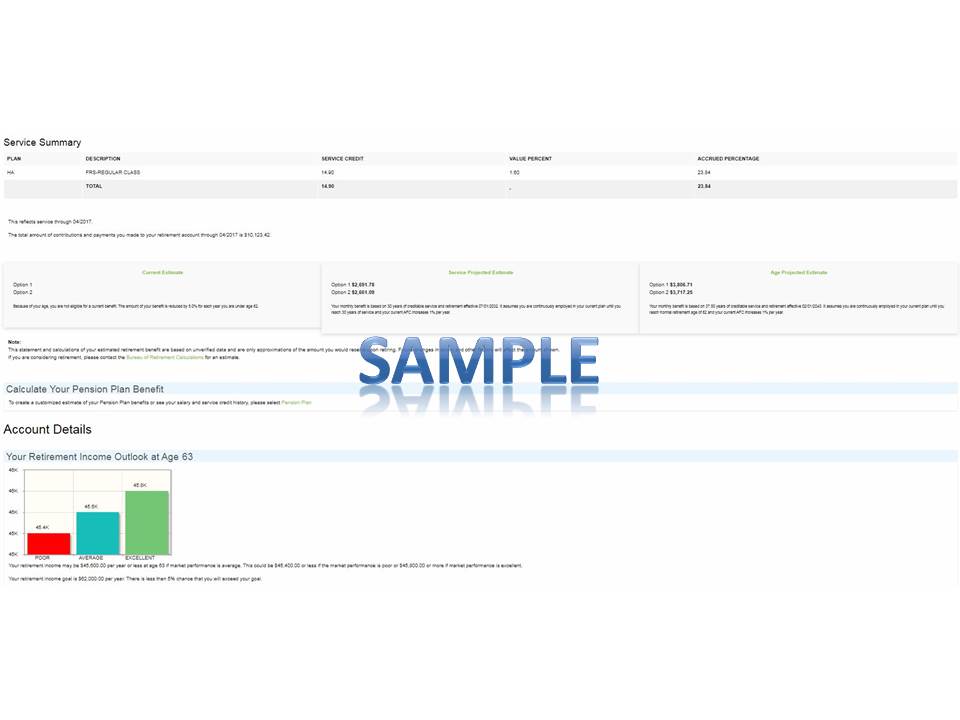

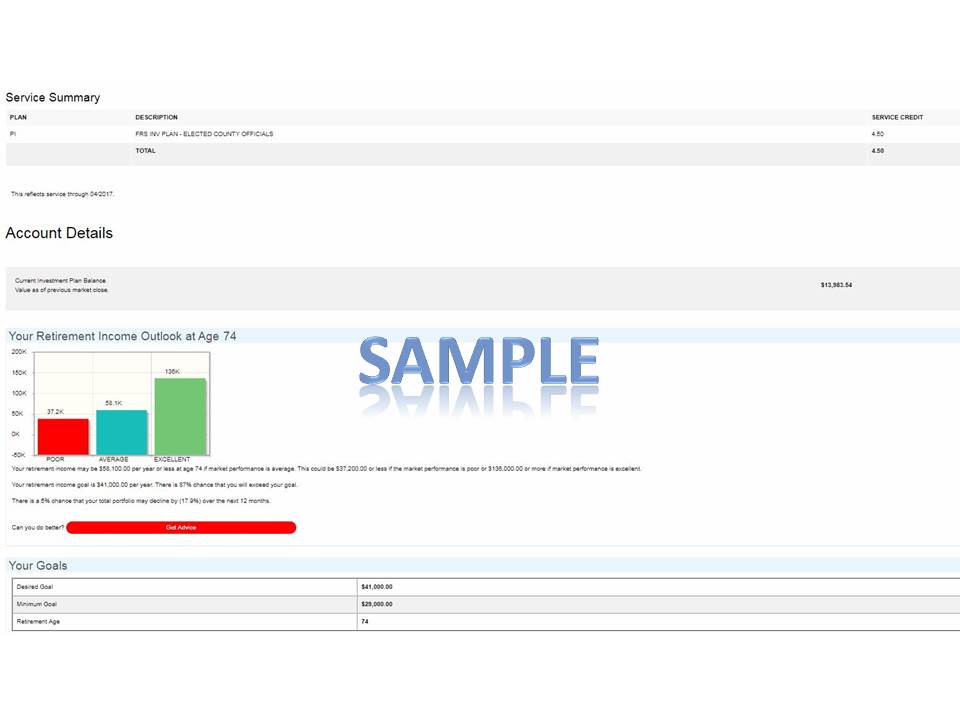

| Plan Type | |

| Quiz Date: | |

| Plan Code: | |

| Elections Remaining: | |

| Election Group: | |

| Election Start Date: | |

| Election End Date: | |

| Election Effective Date:(Advisor and Second choice are available one month from this date) | |

| Member Role: | |

| Age Restricted: | |

| Age: | |

| IP Distribution: | |

| Initial ABO or Current AAL? | |

| Years of Service: | |

| Salary: | |

| Employee Contributions: | |

| Account Locked: | |

| Failed Login Attempts: |